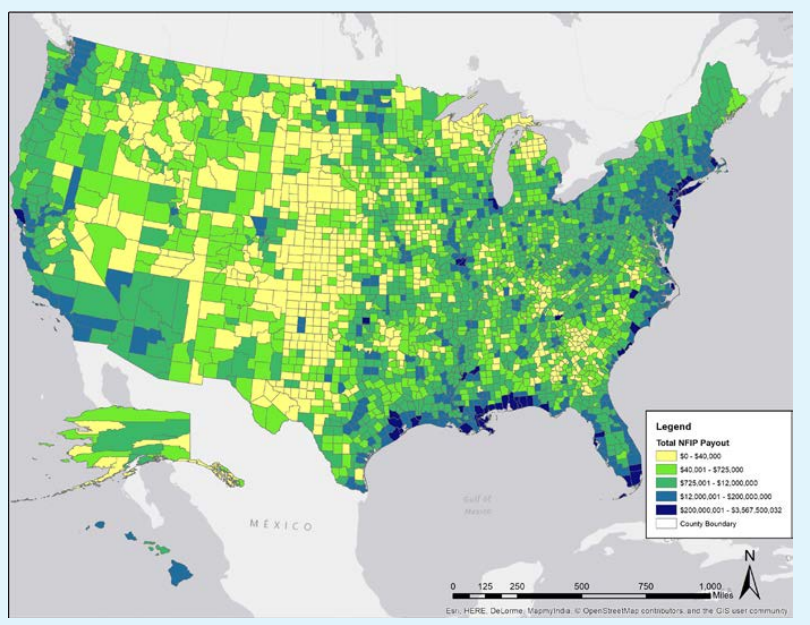

Flooding is one of the most common disasters in the United States. Flooding has resulted in billions of dollars-worth of property damage, as well as hundreds of lost lives across the country (Figure 1). Whether due to heavy rains, high rivers, coastal storm surges, or broken plumbing, floods can impact homes anywhere in the United States causing damages ranging from minimal to catastrophic (Figure 2).

The National Weather Service (NWS) reports that between 1984 and 2013, flood losses in the United States from freshwater sources were estimated to be $238 billion. This estimate does not include damages from coastal storm surge events (e.g., Sandy and Katrina). In 2017, New York University’s Fuhrman Center reported that “an average of 15 million people nationwide lived in the 100-year floodplain in 2011-2015, representing nearly 5% of the nation’s population. More than 30 million people—nearly 10% of the nation’s population—lived in the combined 100- and 500-year floodplain during this period.

National Flood Insurance Program

As described in FEMA P-1037, 2015 , Congress passed the Homeowner Flood Insurance Affordability Act (HFIAA) in 2014. In fulfillment of Section 26 of that act, the Federal Emergency Management Agency (FEMA) established guidelines for property owners that:

- Provide alternative mitigation methods, other than building elevation, to reduce flood risk to residential buildings that cannot be elevated due to their structural characteristics.

- Inform property owners about how these alternative mitigation methods may affect flood insurance premium rates under the NFIP. NFIP flood insurance premiums are based on a number of factors, including flood risk zone, elevation of the lowest floor relative to the base flood elevation (BFE), the type of building and foundation, the number of floors, and whether there is a basement or enclosure below an elevated building. The “lowest floor” is the lowest enclosed area (including a basement). An unfinished or flood-resistant enclosure, usable solely for parking of vehicles, building access, or storage, and having proper openings, is not considered a building’s lowest floor. Note that in V Zones, if the area under an elevated building is enclosed, the bottom of the enclosure would be considered the lowest floor.

As described in FEMA P-1037, existing homes that are retrofitted but are not “Substantially Damaged” or “Substantially Improved” may be eligible for NFIP flood insurance premium reductions. According to FEMA, a building is “Substantially Damaged” or “Substantially Improved” if it has sustained damage or undergone improvement (i.e., reconstruction, rehabilitation, addition) where the cost of the damage or improvement exceeds 50% of the market value of the building before the damage occurred or improvement began. As with new construction, “Substantially Damaged” or “Substantially Improved” structures must be re-built in conformance with NFIP and local floodplain management regulations.

Current flood insurance rating framework does not provide premium reductions for all flood mitigation measures. Even if flood insurance premium reductions are not available, flood mitigation measures should still be considered to reduce damages and financial losses.

The Design and Retrofit for Flood Protection information guide presents the basic approaches to mitigating flood risk for buildings. Flood protection measures can be rated under the existing NFIP framework such that implementation of these measures may result in flood insurance premium reductions. The amount of the premium reduction will vary on a case-by-case basis. Per FEMA P-1037:

- Interior modification and retrofit measures such as basement infill, abandoning the lowest floor, and elevating the lowest interior floor can moderately to significantly reduce flood risk. The flood insurance rating framework is presently in place to allow homeowners to receive flood insurance premiums that reflect any flood damage reduction protection provided by these measures. Use of these measures may result in buildings that meet current NFIP minimum requirements and the local floodplain ordinance, if the lowest floor is elevated to or above the BFE or locally adopted regulatory flood elevation.

- Wet floodproofing measures such as installing flood openings, elevating building utilities, floodproofing building utilities, and using flood damage-resistant materials (Figure 3) can moderately reduce flood risk and damage to utilities, floors, walls, and other areas subject to flooding. FEMA will need to undertake further analysis to determine whether it is appropriate to offer flood insurance premium discounts for undertaking such measures, and if so, what level of discount is appropriate for each measure.

- Dry floodproofing such as a passive dry floodproofing system and barrier measures such as floodwalls (with and without gates) and levees (with and without gates) can moderately to significantly reduce flood risk in areas subject to shallow flooding. FEMA will need to undertake further analysis to determine whether it is appropriate to offer flood insurance premium discounts for undertaking such measures, and if so, what level of discount is appropriate for each measure.

Terminology

Base Flood Elevation (BFE): Elevation of flooding, including wave height, having a 1 percent chance of being equaled or exceeded in any given year (also known as “base flood” and “100-year flood”). The BFE is the basis of insurance and floodplain management requirements and is shown on FIRMs.

Design Flood Elevation (DFE): The elevation of the highest flood that a retrofit method is designed to protect against. This is often a regulatory flood elevation adopted by a local community. If a community regulates to minimum NFIP requirements, the DFE is identical to the BFE. Typically, the DFE is the BFE plus any freeboard adopted by the community.

Dry Floodproofing: Protecting a building by sealing its exterior walls to prevent the entry of flood waters.

Wet Floodproofing: Protecting a building by allowing flood waters to freely enter and exit the space.

Scouring: Process by which flood waters remove soil around objects that obstruct flow, such as the foundation walls of a house.

NFIP: National Flood Insurance Program

Flood Insurance Rate Map (FIRM): A map produced by FEMA to show flood hazard areas and risk premium zones. The SFHA and BFE are both shown on FIRMs.

Special Flood Hazard Area (SFHA): Land areas subject to a 1 percent or greater chance of flooding in any given year. The NFIP’s floodplain management regulations must be enforced in these areas. They are indicated on FIRMs as Zone AE, A1-A30, A99, AR, AO, AH, V, VO, VE, or V1-30. Mapped zones outside of the SFHA are Zone X (shaded or unshaded) or Zone B/Zone C on older FIRMs.

Coastal High Hazard Area (CHHA): A Coastal High Hazard Area (CHHA) is identified as Zone V or Zone VE on FEMA flood maps.

Zone VE and V: Called “V zones”, these are areas where waves and fast-moving water can cause extensive damage during the base flood event. In V zones, wave heights are larger than 3 feet. The label Zone VE refers to areas for which a detailed study has been done and base flood elevations (BFEs) have been calculated. The label “Zone V” means that a detailed study has not been done for the area, so BFE has not been calculated but wave hazards are still expected. Structures in areas mapped as Zone V and Zone VE are subject to stricter building requirements because of the higher risk of damage from strong waves.

Zone A: Coastal Zone A areas include areas landward of a V Zone, or landward of an open coast without mapped V Zones. In a Coastal Zone A, the principal source of flooding will be astronomical tides, storm surges, seiches or tsunamis, not riverine flooding.

Zone AE: Zone AE is used to label parts of the SFHA on flood maps in coastal and non-coastal areas. In coastal areas, AE zones indicate areas that have at least a 1-percent-annual-chance of being flooded and wave heights are less than 3 feet. For Zone AE, detailed analyses have been performed and BFEs have been calculated.

Zone AO: Zone AO shows areas at risk of flooding during the base flood, where water 1 to 3 feet deep flows over sloping ground. On coastal maps, Zone AO usually marks areas at risk of flooding from wave overtopping, where waves are expected to wash over the crest of a dune or bluff and flow into the area beyond. In AO zones, flood depth is expressed as a height above natural ground. Homes and other buildings in these areas are still vulnerable to flooding from waves, even if they are on higher ground or behind a wall or other structure.

Flooding Guides

The following guides provide information on making the components and assemblies of a home more resistant to floods.

Roof:

Walls/Windows/Doors:

- Windows and Doors are Fully Flashed

- Windows have impact-rated glass or protective coverings.

- Exterior doors are impact rated or have protection systems.

- Garage doors pressure-rated.

- Air Sealing Doors Adjacent to Unconditioned Space

- Windows and Doors are Fully Flashed

Building Attachments:

Foundation/Site:

- Flood-Resistant Pier, Pile, Post, and Column Foundations

- Flood-Resistant Crawlspace Foundation

- Flood-Resistant Raised Slab Foundations

- Water-Resistant Flooring

- Erosion Control for Slopes, Stream Banks, and Dunes

- Site Drainage Practices to Minimize Localized Flooding

Operations/Equipment:

- Storage space for emergency supplies

- Automatic Gas Shutoff Valves

- Outdoor HVAC Equipment Elevated and Secured for Resistance to Floods, Earthquakes, and High Winds

- Water Heater Elevated and Secured

- Fuel Tanks Anchored for Disaster Resistance

Design:

In addition to these guides, the Solution Center contains an extensive collection of references, training videos, images, and webinars on disaster-resistant construction related to flooding. These can be found by searching “flood” in the Solution Center.

More Info

The following authors and organizations contributed to the content in this Guide.