Opportunity for Remodeling Contractors!

Many remodeling projects provide rare access to a home’s interior or exterior and a perfect opportunity to upgrade or update a home’s energy efficiency. RMI, the National Renewable Energy Laboratory (NREL), Lawrence Berkeley National Laboratory (LBNL), and the Pacific Northwest National Laboratory (PNNL) have collaborated to develop a process to recommend specific upgrade packages for that purpose. The Retrofit Decision Tool is a way for homeowners and contractors to quickly understand which energy efficiency upgrade package can lead to zero carbon alignment (a metric that is further defined on the Retrofit Decision Tool landing page).

Complete your Project!

Buildxact makes it fast and easy for you to complete these energy upgrade projects by streamlining the process to:

- Develop a bill of materials for each upgrade package

- Build an estimate

- Connect to a dealer to order materials, and

- Send professional quotes to customer.

Siding Contractors

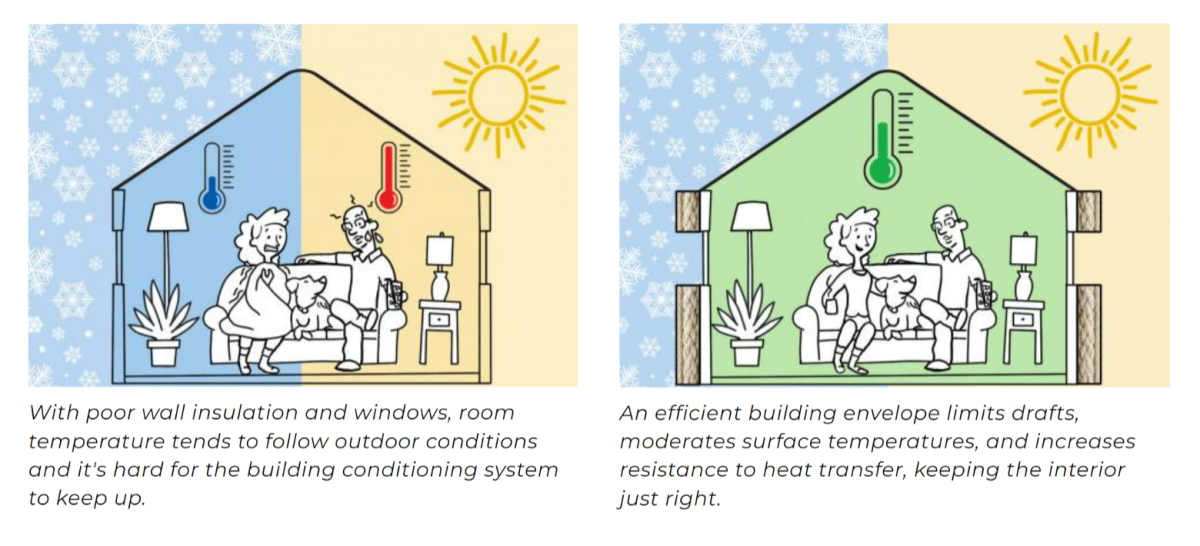

Siding replacement projects are an excellent opportunity to insulate and air-seal a home's walls. Re-siding projects provide rare access to a home's exterior, making window and insulation renovations a handy and cost-effective option. By performing these upgrades during an already scheduled and budgeted re-siding project, homeowners can save thousands of dollars while adding only a few days to the project and avoiding the disturbance that separate projects would cause. The result is much greater comfort and lower utility bills - about 15% on average.

PNNL is leading an outreach campaign called Adding Insulation When Re-Siding to help remodeling contractors with:

- Understanding the rationale for adding wall insulation and/or low-e storm windows to the scope of your projects

- Installation guidance including design tools, and

- Tips on how to communicate the benefits to homeowners.

HVAC and Plumbing Contractors

When fossil fuel HVAC systems or water heaters fail, it is a perfect time to think about going all-electric with a space conditioning heat pump (which also acts as an air conditioner) and/or a heat pump water heater. PNNL is developing tools for HVAC and plumbing contractors who might be unfamiliar with heat pump technology, to more easily understand how to specify a heat pump for space conditioning or water heating needs, and how to avoid pitfalls when installing them. New cold climate heat pumps make this option feasible in nearly all regions! If you would like more information or to beta test these tools, please contact Alek.Parsons@pnnl.gov.

National Incentives and Rebates for Home Energy Efficiency Projects - Inflation Reduction Act

On Aug. 16, 2022, President Joseph R. Biden signed the landmark Inflation Reduction Act (IRA) into law. The law includes $391 billion to support clean energy and address climate change, including $8.8 billion in rebates for home energy efficiency and electrification projects.

These home energy rebates will help American households save money on energy bills, upgrade to clean energy equipment and improve energy efficiency, and reduce indoor and outdoor air pollution. The U.S. Department of Energy (DOE) estimates that these rebates will save households up to a $1 billion on energy bills each year and support over 50,000 U.S. jobs. This website includes information about the IRA Home Efficiency Rebates and Home Electrification and Appliance Rebates.

DOE and the U.S. Department of Treasury have found that the Home Energy Rebate programs will be treated as a reduction in the purchase price or cost of property for eligible upgrades and projects, and consumers receiving an Inflation Reduction Act rebate will not be required to report the value of the rebate as income. Once the Home Energy Rebates are available, eligible rebate recipients may also claim a 25C tax credit for eligible products as applicable to the cost to the consumer after the rebate has been applied, if they have sufficient tax liability. More information about Energy Efficient Home Improvement Tax Credits is available here.

The Home Improvement Tax Credits are available right now! The home energy rebates are coming soon. This website will be updated as soon as rebates become available. They will roll out for different states at different times depending on when the state applies for the funding, and how quickly they can establish rebate processing mechanisms. Check back frequently so you can be prepared to maximize support for your home energy projects!